BC’s New HST Tax

Dr. Mir F. Ali has written a primer here on the introduction of BC’s new HST tax which I think should stir up some controversy. Whether or not you are in favour of this tax (it’s too early to make a solid decision) it will be interesting to watch the debate over the next few months. If the NDP doesn’t go ballistic over this, I’d be surprised, but I guess we’ll see. My first impression is that we’re going to be shifting more of the tax burden onto the average working person and of course this is nothing new. This has been the trend with conservative governments for the last 40 years. I’ve read Naomi Klein’s latest book, The Shock Doctrine and you should too.

You’ll note that the organizations that are having their taxes reduced are: mining companies, forestry companies, manufacturers, etc… ie., the large corporate interests which, for the most part, are foreign owned. The guy paying more tax is the small business owner taking his partner out to dinner and paying more for his meal and drinks. Sure there are all sorts of tax rebates and credits thrown into the mix, but what government is going to go through all this trouble if they aren’t going to increase their revenues…what’s their motivation for stirring up such a pot? One can only wonder. It can’t be because they want to stimulate the economy or why would they put the burden on the consumer…if I don’t think I can afford to go out for dinner and have fun with my friends for a night on the town… I will feel more impoverished and less confident in the economy. The economy, lets not forget, runs on confidence.

But in the end what’s this got to do with non-profits…it remains to be seen, but all non-profits should start to examine this legislation and find out how it’s going to effect their clients and their staff, most of whom are marginally paid. It’s these folks who now will be paying more tax instead of the mining companies. Sure small business gets a harmonization and an elimination of the PST, but their staff and owners just get dinged when they go out for after work drinks…Want to stimulate small business which is actually the backbone of the province? Cut all personal income taxes on the first $100,000 of earnings and have the HST and let people go spend their money.

So I thank Mir for sending me his Primer which is a great introduction to the issue and I look forward to lots of comments on this.

A Glance at the Harmonized Sales Tax in British Columbia

Dr. Mir F. Ali

Premier Gordon Campbell and Finance Minister Colin Hansen announced on Thursday, July 23, 2009 that British Columbia will be implementing a harmonized sales tax (HST) subject to the condition that the Parliaments of Canada and British Columbia pass the Act. B.C. will have the lowest HST in Canada, by combining the seven per cent B.C. Provincial Sales Tax (PST) with the five per cent federal Goods and Services Tax (GST), for a single sales tax rate of 12 per cent.

The Province of B.C. and the Government of Canada have signed a Memorandum of Agreement setting out their intention to establish an HST in British Columbia effective July 1, 2010. The agreement establishes a framework for the proposal, setting out key features such as the timing, the tax base, the rate and the flexibility available to the province.

The HST would be administered by the federal government in the same way that they now administer the GST and the HST in other HST provinces. The federal government would provide revenue to the province based on an allocation formula which also means that:

- Reduction of paper work for businesses now collecting PST and GST;

- Single tax charged and paid to CRA;

- One combined sales tax return; and

- Will no longer be two levels of government audits.

Here is some background information on Canada’s sales tax:

- 1991, the Canadian federal government replaced its broad-based manufacturers’ sales tax (”FST”) with the national value-added tax (”VAT”) – the Goods and Services Tax (”GST”);

- Since that time, four provinces – Quebec (1992), Nova Scotia, New Brunswick, and Newfoundland & Labrador (1997) – have converted their provincial retail sales tax (”RST”) systems into a form of value-added tax that is virtually identical in principles and scope to that of the GST;

- Five provinces – British Columbia, Ontario, Saskatchewan, Manitoba, and Prince Edward Island – still rely upon their older retail sales tax systems. This leaves Canada in a unique situation. It is one of only two member nations of the Organization for Economic Development and Cooperation (”OECD”) that still utilizes the retail sales tax system to tax consumption (the other OECD member being the United States); and

- On March 26, 2009 Ontario announced a plan to move to a single sales tax system – bringing the percentage of the Canadian population under HST to 68% and modernizing Ontario’s tax system to be competitive with 130 countries in the world.

According to Professor Michael Smart (2007) of the University of Toronto who examined the effects of harmonization in Atlantic Canada for the C.D. Howe Institute and made the following two important conclusions:

- After the 1997 reforms, per capita investment rose by more than 11% in the harmonizing provinces compared to the non-harmonized provinces. In addition, total investment in machinery and equipment increased by over 12% annually above the level of investment that existed prior to the 1997 reforms (Smart, 2007); and

- There was almost no change in overall prices even though a whole set of goods and services were now subject to the harmonized provincial sales tax. Specifically, he found that consumer prices in the harmonizing provinces fell after the 1997 reforms, which somewhat offset the imposition of the sales tax (Smart, 2007).

Finance Minister Colin Hansen estimated that the HST will remove over $2 billion in costs for B.C. businesses. That includes an estimated $1.9 billion of sales tax removed from business inputs, which enhances competitiveness, increases investment and productivity and, ultimately, increases prosperity. For example, some savings would include about $880 million for the construction industry, $140 million for manufacturing, $210 million for the transportation industry, $140 million for the forestry sector, and $80 million for mining and oil and gas. In addition, B.C. businesses will also save an estimated $150 million annually in compliance costs. Similar to PST exemptions, the B.C. HST will provide consumers with point-of-sale rebates on a number of products including gasoline and diesel fuel for motor vehicles, books, children’s-sized clothing and footwear, children’s car seats and car booster seats, diapers and feminine hygiene products.

The proposed HST will include:

- Unlike any other province, B.C. will provide an automatic point-of-sale rebate so consumers do not have to pay the provincial portion of the HST at the pump for purchases of gasoline and diesel fuel for motor vehicles, including any biofuel components;

- A partial rebate of the provincial portion of the single sales tax for new housing to ensure that new homes up to $400,000 will bear no more tax than under the current PST system, while homes above $400,000 will receive a flat rebate of about $20,000;

- A refundable B.C. HST Credit paid quarterly with the GST and carbon tax credit to offset the impact of the tax on those with low incomes; and

- A temporary delay in the provision of input tax credits for certain purchases by businesses with taxable sales in excess of $10 million.

It was also agreed that the federal government will provide BC with $1.6 billion in transitional funding in recognition of the improvement this change will make to business competitiveness in Canada. The full cost of administration will be borne by the federal government, saving the Province an estimated $30 million annually in administration costs. With this decision, the Province can now move forward and work with industry to implement the new HST.

To meet our unique requirements here in the province of British Columbia, the Harmonized Sales Tax would include the following point-of-sale rebates and tax credits for the provincial portion of HST:

- Fuel: Gasoline and diesel motor fuels, including any biofuel components;

- Other items: Books, children’s sized clothing and footwear, children’s car seats and car booster seats, diapers and feminine hygiene products;

- Housing: A partial rebate of the provincial portion of the HST of up to $20,000 on all new housing; and

- Low income tax credit: A refundable B.C. HST Credit to help protect low-income individuals.

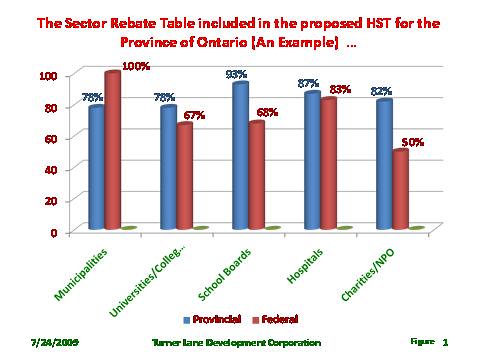

There will be rebates/tax credits for municipalities, charities and eligible non-profit organizations to avoid tax increases for these sectors. And there will also be temporary restrictions of input tax credits for certain purchases by businesses with taxable sales over $10 million and financial institutions.

There is no mention of universities/colleges, school boards, and hospitals under the category of rebates/tax credits but these organizations can be qualified under the term of “non-profit organizations”. The following graph will illustrate the structure that is proposed by the Province of Ontario as a part of their overall proposed HST:

Bob Wilkinson, C.G.A in his report, What will it mean to Business?, which was prepared for BDO Dunwoody LLP on the subject of the HST for Ontario, anticipated the following steps for the conversion/implementation of the HST on July 1, 2010 which are quite appropriate and applicable to situation in British Columbia:

- Convert accounting systems, cash registers to collect harmonized tax;

- Expenses may need to be segregated between pre and post implementation amounts for proper tracking;

- Review filing period (monthly quarterly, annually);

- Planning of significant expenditures as conversion date approaches for businesses;

- Recovery of PST after June 30, 2010;

- Computer hardware/software, equipment, vehicles; and

- Consumers – expenses subject to provincial component consider acquiring before June 30, 2010 (real estate acquisitions).

The proposed HST sales tax will be applicable to the same goods and services that the GST applies to, not to mention that it will include many items that were not subject to PST. All goods and services which are currently subject to only GST (5 percent), will be taxable at the rate of 12 percent. For instance, the tax on the food and beverages in the restaurants will go up from 5 to 12 percent. This is indeed a bad news for the restaurant industry which is already suffering from the economic downturn. History has shown that a seven-per-cent price increase translates into a seven-per-cent loss in sales, von Schellwitz said. “That’s going to cost our industry in B.C. annually $750 million,” he said.

According to the Ministry of Finance, the following goods and services are currently exempt from provincial sales tax (PST), but will be subject to the full 12-per-cent harmonized sales tax when it is implemented next July. With the new HST, businesses will be able to recover the PST portion of the tax they currently pay, rather than passing it on to consumers as part of the price of these items. Theoretically, that should mean that prices for these goods will come down by seven per cent as they become subject to the full tax.

• GOODS: Residential fuels (electricity, natural gas) and heating; Basic cable TV and residential phones; All food products (only basic groceries will remain exempt under new tax); Non-prescription medication; Vitamins and dietary supplements; Bicycles; School supplies (books will continue to be exempt); Magazines and newspapers; Work-related safety equipment; Safety helmets, life jackets, first-aid kits; Smoke detectors and fire extinguishers; and Energy conservation equipment (e.g., insulation, solar power equipment).

- SERVICES: Personal services such as hair care; Dry cleaning; Repair services for household appliances; Household maintenance such as renovations and painting; Real estate fees; Membership fees for health clubs; Movie and theatre tickets; Funeral services; Professional services such as accounting and home care; and Airline fares within Canada.

Members of the Canadian Federation of Independent Business are split on the tax, Brian Bonney, the director of provincial affairs in B.C., said in an interview.

Dr. Mir F. Ali is a Sustainability Analyst with Turner Lane Development Company, a real estate development company with the commitment to build sustainable communities in British Columbia, Canada. (mir@turnerlane.com).

Comments